JPMorgan expects a recession this year, with unemployment rising to 5.3%, per a Friday note from chief economist Michael Feroli, making it the first major financial firm to call the R-word.

We’re getting used to recession talk, but we shouldn’t lose sight of what a stunning turn of events this is or what it means. Recessions bring misery. Millions of people lose their jobs and those fortunate to keep their jobs go without raises.

That could be an especially painful feature of this impending recession, because President Trump’s economic policies also are likely to bring back the inflation that had been tamed in recent months.

Biden-era inflation sucked, and the effects still suck, but wages rose faster than prices, so the average American came out the other side in better shape. Now, we appear headed for stagflation, a combination of rising unemployment and rising prices. That would be worse.

Pain was not inevitable

Recessions do not have to happen. The U.S. economy can go years and decades without them, as it did between the Great Recession and COVID-19 pandemic.

No one was predicting a recession three months ago. No one was predicting a recession two months ago. Almost no one was predicting a recession one month ago (Ball State economist and IndyStar columnist Michael Hicks called it March 6).

The reason we might have one now is unambiguous. We are hurtling toward recession because one person, Trump, has a longstanding, sincere belief that other countries are taking advantage of America and that tariffs (import taxes that get passed onto consumers) are the solution.

How Trump views tariffs

Trump is guided by a view that trade deficits are unfair to America.

Vietnam, for example, produces a lot of clothes because its workers make shirts and shoes at lower costs than American workers, while we have disposable income to buy those goods. Vietnamese citizens earn much lower wages (per the previous sentence), so they do not buy many goods from us.

Hence, we have a very large trade deficit with Vietnam.

Labor ethics aside, this arrangement works for both countries. Or, it did. Trump sees America’s trade relationship with Vietnam as egregious because the people of Vietnam are not buying goods commensurate with the Nikes and Lululemon yoga pants that adorn American consumers. They can’t afford to.

Nonetheless, Trump this week applied a 46% tax to products from Vietnam as part of his Liberation Day tariffs for every place on Earth, including uninhabited islands, yet somehow excluding Russia.

As Josh Barro wrote, “This policy is so stupid I barely even know what to say about it.”

Before Trump, most agreed tariffs are bad

The pre-Trump baseline view across the political spectrum was that tariffs are self-destructive and America did not have a trade problem. JD Vance held this view, as did virtually every other prominent conservative, including the ones now pretending Trump’s likely AI-generated tariff formula is good and smart and a revival for American manufacturing.

In order to buy Trump’s position, you have to accept two assumptions:

Trump is a singular economic prophet who has been granted wisdom unattainable for everyone else, minus a few protectionists.

America is in such critical condition that we must blow up the stock market and global economy to adopt Trump’s AI-designed tariff plan.

Personally, I do not think Trump is a prophet. I guess we’ll find out.

What I do know is that the U.S. economy does not have a major problem in need of a maximally invasive solution. Or, at least, it didn’t. The Friday jobs report was phenomenal, an indication that employers were still cooking up until the very moment when Trump took us to tariff town.

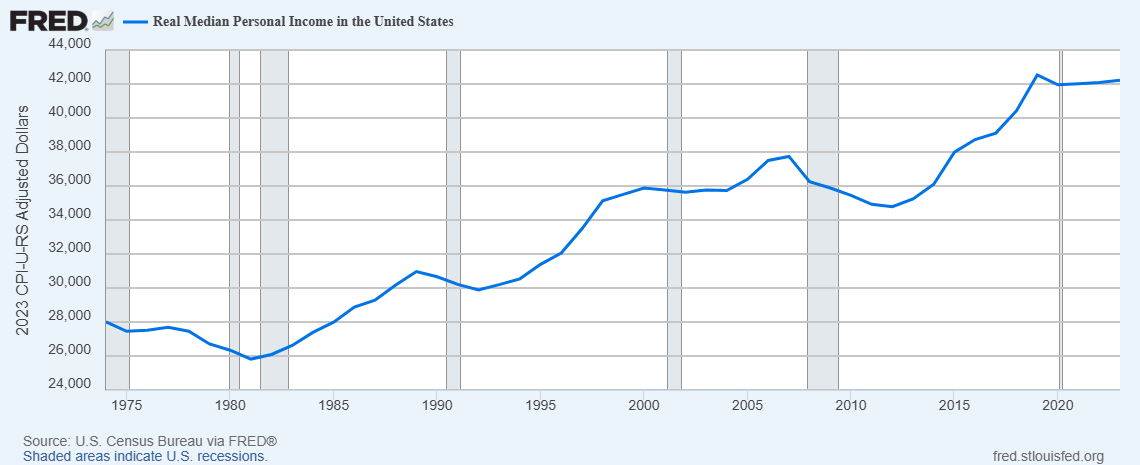

Zooming out, Americans have been steadily gaining wealth for decades. Look at this chart and explain how this could happen if every other country in the world is screwing us.

America is prosperous. Trump is singlehandedly making us poorer via executive action. This isn’t hypothetical. He’s already doing it. Check your retirement account. Spoiler: It’s down.

As Nate Silver points out, this week’s public company winners (such as they are) and losers reflect a recession-expectant market. Retailers that sell cheap goods are performing better than those that sell expensive goods.

That’s a forward-looking bet by traders that disposable income is about to dry up and people will be shopping more at Costco and less at Restoration Hardware (“Oh, shit,” RH CEO Gary Friedman said during an earnings call Thursday amid Liberation Day festivities, a candid reaction to the sand shifting beneath his feet).

To be clear, traders aren’t making political choices based on how they feel about Trump. They’re making high-stakes predictions with their money based on how they think the economy will change. Right now, they predict that Trump is dragging the economy to a dark place — and they’re directing resources accordingly.

I see three possible paths to a good (or not-terrible) outcome: Trump caves under pressure, Congress does its damn job and intervenes or it turns out that Trump is right and everyone else is wrong.

Trump seems to be leading a YOLO second term unconstrained by consequences, so I don’t think he’ll cave. Most congressional Republicans are not taking tariff-induced economic risks seriously yet, so I don’t expect them to act. I guess we’re just going to have to wait and see what happens.

Republicans should be taking this seriously, though, because a recession of choice — understood as such by voters — would be a political catastrophe. Americans could soon feel enough misery to reset our politics.

Silver sums up the situation like this:

If Wall Street is right and we get to the point where Americans are stocking up on booze and cigarettes but avoiding buying new toys or taking their kids to Six Flags — and don’t even dream of upgrading their cars or their homes — and all of this is because of some back-office employee who used ChatGPT to upend the global trade system … look I don’t know what the bottom is in Trump’s approval ratings. But it will be tested in a way it probably never was during the first term. There’s no constituency for this, and the excuses you’re seeing from Silicon Valley are transparent cope. Trump just basically has to hope that Wall Street is wrong, or that the economy, which was pretty good when he took office, has enough gas in the tank to ride it out.

Trump was a bad choice for president

Conor Sen, a former hedge fund analyst who writes for Bloomberg, says if Trump’s current tariff policies stand for two months without the president caving or Congress intervening, “we’re talking about stocks down 50% and a credit liquidity crisis.”

Do you know how we could have avoided a recession, a 50% market drop and a credit liquidity crisis? By electing Kamala Harris president.

I didn’t love Harris as a candidate, but I am 100% confident neither she nor any other plausible presidential candidate from any party would be causing so much damage. I know everyone claims their political opponents hate America and will ruin the country, but we’re experiencing a historically rare level of self-sabotage.

Trump didn’t run on some dubious promise of short-term pain for long-term gain. If he did, he might have lost the election. Instead, he ran on fixing an economy that was supposedly awful under Biden.

I launched this newsletter with a note of optimism that the economy was strong and I thought Trump would just let it ride and take credit for it. We can now say unequivocally he is breaking it. Prominent conservatives, from Mike Pence to Erick Erickson, are saying as much.

The MAGA figures most committed to the bit are spinning how, actually, you crybabies don’t need to buy stuff; you shouldn’t have expected Biden-era market gains forever; it’s fine because markets have dropped in the past; retirement accounts don’t matter and traders are only selling off to turn you against Trump.

This is the pro-Trump message now: Yes, things are bad, but you have to trust that Trump is going into Hulk Smash mode in order to make America better in the long run.

I do not buy that case. Trump has a long record in real estate development, casinos, TV and politics. The one constant is that Trump destroys things and somehow ends up personally better off, leaving everyone else to pick up the pieces of his failure.

Trump is treating the U.S. economy like one of his bankrupt casinos. Republicans in Congress can do something about it if they want to. All the rest of us can do is hope things somehow turn out better than they did in Atlantic City.

Spot on James! Thanks.

Best commentary ever!